Often small businesses get confused when it comes to making proforma and interim invoices. While the former is an estimate, the latter breaks down big project costs into smaller chunks. All you need to do is invest in good online invoicing software, and you will be able to make multiple invoices. This post will discuss the main differences between a proforma and an interim invoice. Ready, let’s dive in!

Pro forma Invoice

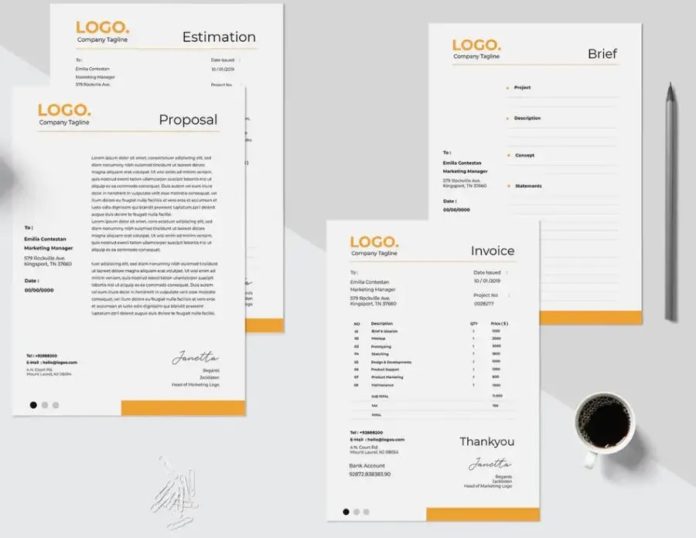

A proforma invoice is an estimate of the cost of products and services once the work is completed. You can use proforma invoice templates to save time and reduce efforts as compared to manual methods. They are mostly used for larger products. This helps your customers get an idea of the project scope, get a cost breakdown, and the total due amount once the project is delivered.

Interim Invoices

Interim invoices are designed to break down larger payments into smaller payments. So, rather than sending one invoice, you send several small ones during the project duration.

You can easily manage all the details with your online invoicing software and maintain your cash flow. Else, you will need to wait for months to get your payments. They are also ideal for your customers as they help them manage costs into smaller portions and avoid lump sum payments.

Why Should Small Businesses Use Proforma Invoices?

The main benefit of using these invoices is that they are not final. You will not need to revise it if there are changes to your goods and services. Thus, it will help you cut down your admin’s job, and you can wait till your sales are fully confirmed, and then you can add/delete any charges.

Here are some places you can use proforma invoices:

Items Damages/Harmed During Transit

such an instance happens, all you will need to do is send a credit. So, you can easily make necessary changes and then turn it into a sales invoice and save big time on efforts.

If Customers Change Their Order

When a customer decides to make changes to an order, your initial invoice will no longer be correct, and you will need to raise it again. Luckily, you can raise it again with proforma invoice templates and convert it into a full invoice.

When There Is A Change in Scope

Let’s say if you have offered a particular service, but a few days later, you realize more work will be needed, you will need to send out additional invoices. Thus, proforma invoices help you finalize the sale and keep the process simple and fast.

Benefits of Using Interim Invoice

Coming to interim invoices, here is how they can help you.

-

Stable Cash Flow

A major advantage of sending interim invoices has a smooth cash flow. You will not need to wait for months and will be able to use the cash for other projects as well.

Most businesses shut down due to cash flow issues. But, with interim invoices, you can solve these problems and scale your business faster.

-

Reduced Risk

When you invoice in time, you will get paid faster. You will not need to wait for the project tenure to end. Also, you will be assured that your other payments will be cleared on time too.

-

Gauge The Clients

Not all customers will pay you on time. Sending interim invoices will help you figure out which customers are worth handling and which have to be laid off. You can even consider canceling the project if customers regularly default on payments.

-

More Flexibility For Clients

Online invoicing software lets you manage multiple payments and even send reminders from time to time. This, in turn, boosts customer relations and strengthens your bond. Moreover, there will be trust between both parties, and you can spend your time on other tasks and waste it in following up with clients.

Wrapping Up

These were just a few differences between a proforma and an interim invoice. You can easily use proforma invoice templates to make invoices without missing any details.

Moreover, online invoicing software will help you make detailed interim invoices and get timely payments.

So, save time and put your invoicing on autopilot the latest tools to focus on core business issues!